GST

TAX CALCULATION METHOD

Tally PRIME

GST - Feature

- Wise Tax

Create New Company - Accept Company Details - Activate GST - Yes

· Select the Firm Registration Type (Regular)

· Select the GSTR1 Return filing - if more than 1.5 Crores.

(select monthly return) otherwise

below 1.5 Crores select (Quarterly return)

·

GST Feature wise tax - set below option –Yes

·

After set - Yes (fill

following details) - e.g. Description - HSN/SAC code and Tax Rate.

Ledger

Creation

1. Local Purchase @ 18% and Inter-State Purchase @ 18%

2. Local Sales @ 18% and

Inter-state Sales @ 18%

3. CGST (Input / Output) with 9%

4. SGST (Input / Output) with 9%

6. LOCAL Creditor (Jankidas)

7.

INTER -STATE Creditor (Vikas)

9.

INTER-STATE Debtor

Create

All Ledger with Correct Group and Back to Gateway of Tally

· Masters - Create

- Units

· Masters - Create - Stock

Group

2. Bajaj Fan

After

create Inventory Details back to Gateway of

Tally

Gateway of Tally -

Voucher

(Press

f9) Purchase

1. Local Purchase

Purchase

40 PCS USHA FAN from Jankidas @ Rs .300 Each. GST Applicable @ 18%

(CGST

9% / SGST 9%) on 1st Apr (Supplier invoice number – 123)

2. Inter-State Purchase

Purchase

30 PCS Bajaj FAN from Vikas @ Rs .500 Each. GST Applicable @ 18%

(IGST 18%) – Supplier invoice number – 453- Purchase on 1st Apr

(I

After

Complete Purchase Check GSTR2 Summary, here we can found our total ITC (input Tax credit).

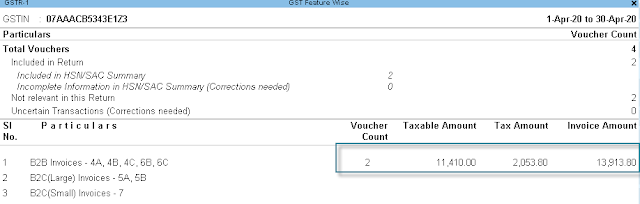

Gateway of Tally à Display - GST Report - GSTR-2

B2B -

Means Company purchase goods from registered dealer (Local / Inter-state)

Press

Enter for more details on B2B invoices, and following entries shows

After Check Report, if we sales Product to Party

- B2B (Regular Dealer)

Gateway of Tally à Voucher - Press F8

1. Sold 10 PCS. USHA FAN to Mr. Harish. @ 450 Rs. -

Discount 2% (GST 18%)

Note:-

Open

- Use Discount column in Invoices from F11 .

2. Sold 10 PCS BAJAJ FANS to Mr. Maneet Sharma @ Rs 700.

(GST Applicable) 18% and Freight charges Rs 450. Note - Create Ledger Freight charges - Under - (Indirect

Expenses)

Check GSTR1 Report for Sales Tax Summary (* Show if Correct GST for Debtor)

Our

ITC is more than for Sales Tax Amount

- So in the month of April our Tax Liability is 0 (Zero) Rupees.

For full

Report while Upload GSTR on Web Portal - Check GSTR-3B

- this is Upload on Web Portal for Filing Return.

· Check

balance Sheet for Duties & Taxes Now

our Reaming ITC Amount show 2,806 Rs.

show on balance Sheet in Current Liabilities Section (If Minus Sign Show (-) then It means our ITC

Available otherwise if Minus sign not show , It means we have to pay that tax

to the government that is our liability)

We can also check Outstanding Payable and Outstanding Receivable Amount from Party-

Display - Statement of Accounts - Outstanding - (Payable/

Receivable) Note- (while creating Part Ledger - Set Bill by Bill option - 'Yes')

otherwise report not show (Press Alt+F1

for show All Entry in Details_

GST-Feature Tax (Practical Question)

Q-Calculate total GST Payable by the XYZ

firm for following transaction

à GST (Feature wise) - 28%

Purchase from Mr. Ajay , Local

(Delhi) GST No - 07AADCB2230M1ZV

· ·

20 PCS DELL LED, 22 Inch @Rs. 9500 each on 1st May

· ·

10 PCS HP LED, 21.5 Inch @ Rs 9200 each on 2nd May

(Discount - 5% on Above

Item)

Purchase from Mr. Sunil ,

Inter-State (Kerala) GST No - 32AAACC4175D1Z7

· ·

10 PCS HCL Laptop, i3 @ Rs 19500 each on 1st May

·

15 PCS Lenovo Laptop, i7 @ Rs 24500 each on 2nd May

(Note- Discount - 7.5% on HCL Brand)

Total

GSTR2 - 2,28,417.00 Rs

Note

- If Tax not show , change the period according to transaction.

Sold to Mr. Chetan , Inter-State

(Bihar) GST No - 10AABCS1429B1Z9 on 1st June

·

12 PCS DELL LED, 22 Inch @Rs. 10200 each

·

7 PCS HP LED, 21.5 Inch @ Rs 9800 each

·

12 PCS Lenovo Laptop, i7 @ Rs 26500 each

Sold to Mr. Prakash , Inter-State (Rajasthan)

GST No - 08AAACH2702H1Z0 on 2nd June

·

7 PCS DELL LED, 22 Inch @Rs. 10300 each

· ·

3 PCS HP LED, 21.5 Inch @ Rs 9900 each

·

10 PCS HCL Laptop, i7 @ Rs 21000 each (Discount - 5%)

Total

GSTR1 - 2,26,884 Rs

Total GST Payable - No GST

Payable because GSTR1 is More than GSTR2

·

Show balance sheet for check

Note - if Duties and taxes show

in negative , it means output tax is lower and Input tax is higher. if Output

tax is higher we have to pay (FILL GSTR) the amount show in duties and taxes section.

·